Independent Medicare agency

"We make Medicare Easy."

info@MaineMedicareChoices.com

Vince Murray- (207) 299-5180

Maine Medicare Choices

We love reviews. Help more people see us.

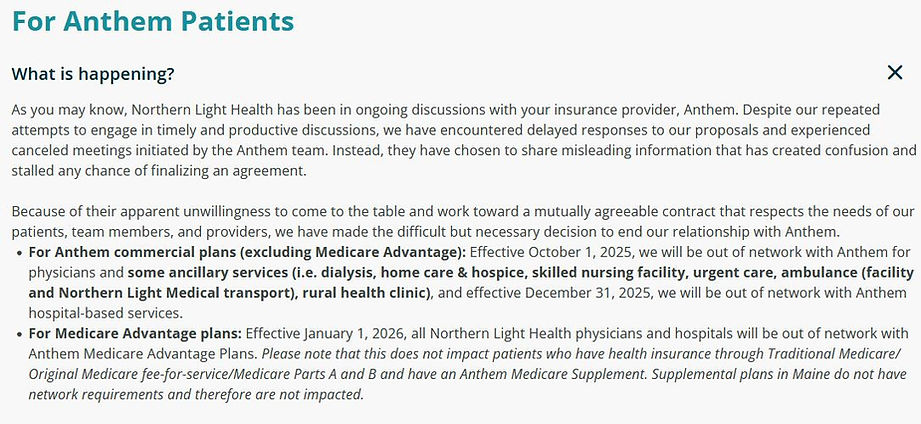

Major Medicare News for 2026

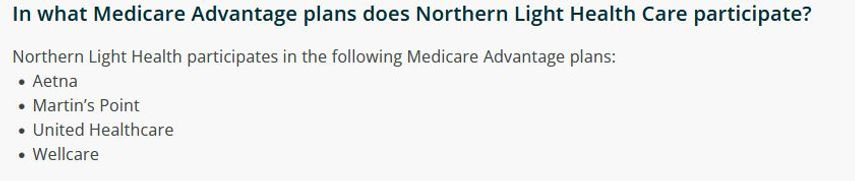

There are 6 Medicare Advantage companies in Maine.

2 aren't accepted by Northern Light.

2 more are not available in this county.

2 are left, 3 if you have Mainecare

Solution: Having a local Medicare Advocate

that can help your with your questions all year long...

We can fix this. Come to our Medicare Meeting on October 15th.

Kenduskeag Terrace November 4th at 2:00

Bradford Commons November 5th at 2:00

Independent Medicare agency "We make Medicare Easy."

We want to provide Answers to your questions, giving you the friendly attentive service we would want for ourselves;

-The answers to your questions are right here.

-The solutions for your specific need.

Hope to talk to you soon.

Vince Murray (207) 299-5180 info@mainemedicarechoices.com

We live right here in Northern Maine. We are available to help you 365 days a year. Please don't call a Quarterback for your local Medicare answers. Over the phone, on Email, or in person we are here to help. Whether you are looking for Medicare plans in Fort Kent, Maine. Medicare plans in Saint Agatha, Madawaska, Medicare plans in Houlton, Lincoln, Millinocket, Ellsworth, Newport, Bangor, or anywhere in between. We can meet in your home or over the phone.

To see Medicare

Advantage plans In Maine

Please call for personal assistance 299-5180

Navigating the 2024 Medicare Advantage Landscape:

What You Need to Know

As we step into the realm of healthcare in 2024, the landscape continues to evolve, especially when it comes to Medicare Advantage. Medicare Advantage plans have been gaining popularity for their comprehensive coverage and additional benefits beyond traditional Medicare. But what exactly does 2024 hold for those considering or already enrolled in Medicare Advantage? Let’s delve into the intricacies and advancements shaping the Medicare Advantage sphere this year.

Understanding Medicare Advantage: Medicare Advantage, also known as Medicare Part C, offers an alternative way to receive Medicare benefits through private insurance companies approved by Medicare. These plans typically include coverage for hospital stays, doctor visits, and prescription drugs, often bundled together with additional benefits like vision, dental, and wellness programs.

What’s New in 2024:

-

Expanded Telehealth Services: The COVID-19 pandemic accelerated the adoption of telehealth services, and Medicare Advantage plans have been quick to embrace this trend. In 2024, expect to see further expansion of telehealth offerings, making it easier for beneficiaries to access healthcare remotely, especially in rural or underserved areas.

-

Focus on Chronic Disease Management: With a growing emphasis on preventive care and population health management, Medicare Advantage plans are increasingly investing in programs to help members manage chronic conditions like diabetes, heart disease, and COPD. Look for plans that offer personalized care management and incentives for proactive health management.

-

Innovative Wellness Benefits: Beyond traditional healthcare services, Medicare Advantage plans are incorporating innovative wellness benefits to promote overall health and well-being. This may include gym memberships, fitness classes, nutrition counseling, and even discounts on healthy groceries.

-

Enhanced Prescription Drug Coverage: As prescription drug costs continue to rise, Medicare Advantage plans are working to enhance prescription drug coverage by negotiating lower drug prices and offering more affordable options for beneficiaries. Keep an eye out for plans with robust formularies and cost-saving initiatives like mail-order pharmacies.

-

Greater Flexibility in Plan Options: In response to evolving consumer preferences, Medicare Advantage plans are offering greater flexibility and customization options. Whether you prefer a traditional HMO, PPO, or newer models like Special Needs Plans (SNPs) tailored to specific health conditions, there’s likely a plan that fits your needs and budget.

Navigating the Medicare Advantage Maze: With so many options available, choosing the right Medicare Advantage plan can feel overwhelming. Here are some tips to help you navigate the maze:

-

Evaluate Your Healthcare Needs: Consider your current health status, prescription drug needs, and any anticipated healthcare expenses. Look for a plan that provides coverage for the services and medications you need most.

-

Review Plan Benefits and Costs: Compare the benefits, premiums, deductibles, and copayments of different Medicare Advantage plans. Pay attention to out-of-pocket maximums and coverage limitations to ensure the plan aligns with your budget and lifestyle.

-

Check Provider Networks: If you have preferred doctors or specialists, make sure they are included in the plan’s provider network. While some plans offer out-of-network coverage, staying in-network can help you save on healthcare costs.

-

Consider Star Ratings: Medicare assigns Star Ratings to Medicare Advantage plans based on quality and performance. Choosing a plan with a higher Star Rating may indicate better overall satisfaction and outcomes for members.

-

Seek Guidance if Needed: If you’re feeling overwhelmed or unsure about your Medicare options, don’t hesitate to seek guidance from a licensed insurance agent, Medicare counselor, or trusted healthcare professional. They can help you understand your choices and make an informed decision.

Conclusion: As we navigate the complex world of healthcare in 2024, Medicare Advantage remains a popular and viable option for millions of Americans seeking comprehensive coverage and additional benefits. With continued innovation and a focus on improving member experience and outcomes, Medicare Advantage plans are evolving to meet the changing needs of beneficiaries. By staying informed, evaluating your options carefully, and seeking assistance when needed, you can find a Medicare Advantage plan that provides the coverage and support you need to live a healthier, more fulfilling life.

Strategic Partnership